Report

Point of No Returns 2023 Part IV: Climate and Biodiversity

Our environment is being radically altered by human activity. We are rapidly running out of time to secure a sustainable and liveable future for people and planet. The climate and biodiversity crises are intimately linked - we cannot tackle climate change without halting habitat loss. Yet climate change is also one of the five major drivers behind the decline in nature.

As stewards of vast amounts of global wealth, asset managers must respond to growing environmental challenges and new regulations that come in their wake. They must take robust steps to prevent biodiversity loss and reduce carbon emissions, in an interconnected way.

This report looks at the climate and biodiversity policies and practices of 77 of the world’s largest asset managers, who collectively hold over $77 trillion in assets under management. We found that asset managers need stronger and more comprehensive net-zero targets. Recognition of the importance of biodiversity has grown, but there are few commitments on biodiversity, and risk assessments remain inadequate.

Almost three-quarters of asset managers had made no commitments on deforestation.

And none had commitments on the conversion of other types of natural habitat.

Forests are critical for preserving biodiversity as they host some of the richest concentrations of biodiversity in the world. They are also crucial for the climate: a net-zero future cannot be achieved without ending deforestation by 2030[i]. Yet only 21 asset managers (27%) have made any commitments on this. Not one asset manager had made any commitments about the conversion of natural ecosystems or set any specific targets to manage investment risks to biodiversity that went beyond their deforestation commitments.

Biodiversity is important for a wide range of ecosystem services, such as providing clean water, filtering air, supporting resilient food networks, and providing cultural value, as well its contribution to managing carbon emissions.

Asset managers’ interim targets are insufficient to fulfil their long-term commitments.

Just $26 out of every $100 managed by asset managers in our survey is included in managers’ interim emissions targets for 2030:

Limiting global warming to 1.5C requires immediate and deep emissions reductions as well as long-term net-zero targets. Asset managers must therefore set robust interim targets for 2030 but are frequently failing to do so. We identified four main shortfalls with how interim targets are being set:

Firstly, just 55 asset managers (71%) have set interim targets for 2030.

Secondly, the interim targets that have been set don't cover all assets. They apply to just 41% of AUM on average. This means that across all 77 surveyed asset managers, 2030 interim targets have only been set for a quarter of their combined assets under management.

Thirdly, just 8 asset managers set targets based on absolute emissions reductions. Others used intensity-based metrics - which don’t necessarily track real-world emissions – or portfolio coverage methods - which risk omitting the biggest polluters and don’t disclose progress (or regression) by those outside the scope.

Finally, many interim targets exclude scope 3 emissions. Measuring and reducing scope 3 emissions is needed to tie emissions targets to the real economy – especially for companies and sectors where they dwarf scope 1 and 2 emissions.

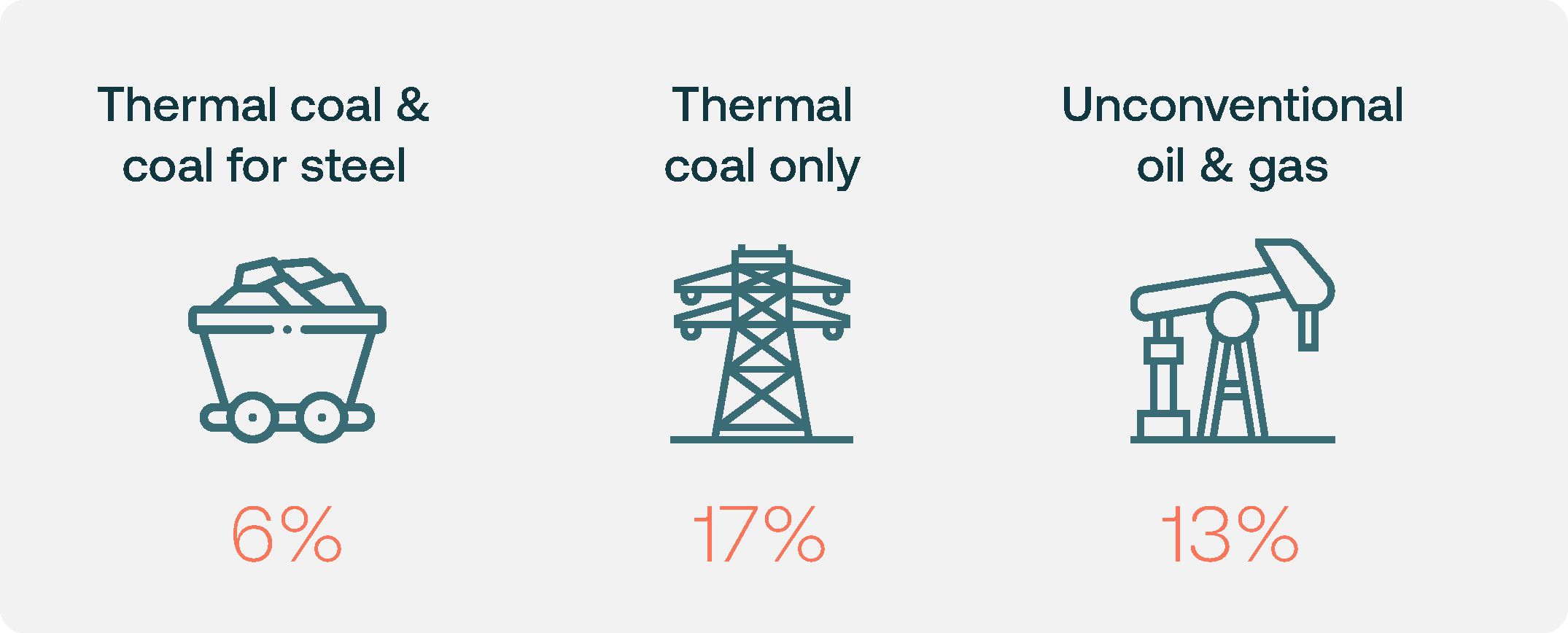

Only 10 asset managers have committed to restrict investment in the most harmful fossil fuels across all funds.

Asset managers with commitments to restrict investment in fossil fuels across all their funds:

Coal and unconventional oil & gas are the most harmful types of fossil fuel. Coal is the most emissions-intensive source of energy[ii]. It is damaging to people’s health as well as the climate[iii]. Unconventional oil & gas extraction methods – such as fracking, or from Arctic oil or oil sands– have more severe effects on the health of nearby communities and the local environment than conventional extraction[iv]. Moreover, unconventional fuels can be more energy-intensive to extract[v]. Yet firms continue to invest in these fuels, despite the lower long-term costs of renewable energy.

Authors: Abhijay Sood, Dr Claudia Gray, Isabelle Monnickendam and Dr Jonathan Middleton

Contributing Authors: Danielle Vrublevskis, Felix Nagrawala, Katie Stewart, and Marina Zorila

Contact: research.secretariat@shareaction.org

ShareAction does not provide investment advice - read our disclaimer here.

Point of No Returns series

Alongside this report we have done a top level overview of asset manager approaches to social issues, such as public health and a more in-depth look into how they are engaging companies through stewardship and governance.

References

[i] UN Climate Change High-Level Climate Champions, Why Net Zero Needs Zero Deforestation Now., 2022.

[ii] IEA (2022) Coal in Net Zero Transitions: Strategies for Rapid, Secure and People-centred Change. In: OECD Publ. https://iea.blob.core.windows..... Accessed 27 March 2023.

[iii] Vohra, K. et al. (2021). Fossil fuel air pollution responsible for 1 in 5 deaths worldwide. Harvard T.H. Chan School of Public Health. Available online at: https://www.hsph.harvard.edu/c-change/news/fossil-fuel-air-pollution-responsible-for-1-in-5-deaths-worldwide/ Accessed 4 May 2023

[iv] Li L, Dominici F, Blomberg AJ, et al. (2022) Exposure to Unconventional Oil and Gas Development and All-cause Mortality in Medicare Beneficiaries. Nature energy 7:177. https://doi.org/10.1038/s41560...;

[v] Lattanzio RK (2014) Canadian Oil Sands: Life-Cycle Assessments of Greenhouse Gas Emissions. https://sgp.fas.org/crs/misc/R.... Accessed 27 March 2023.