How asset managers were selected

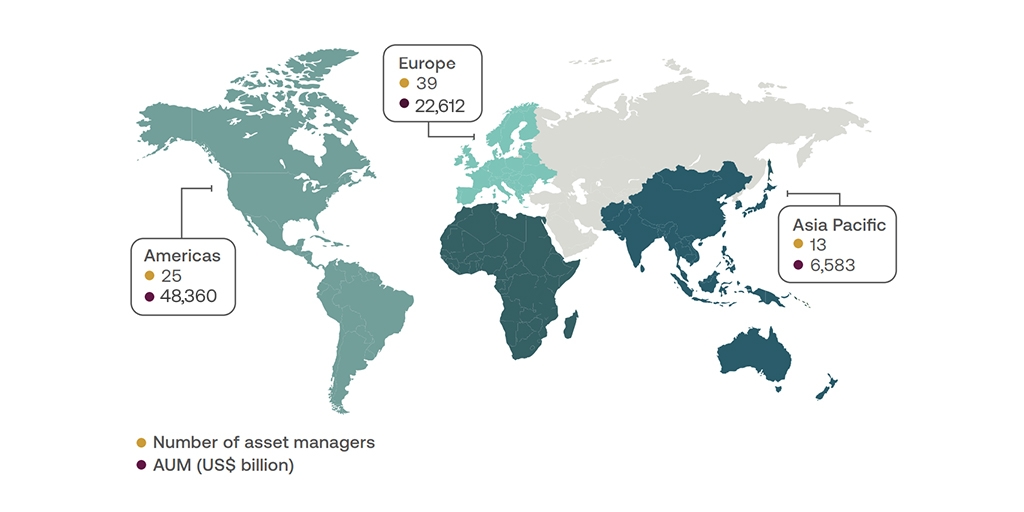

This report features 77 of the most influential asset management companies worldwide across 16 countries. We selected managers based on their assets under management (AUM) according to IPE’s 2021 Top 500 Asset Managers List[i] as well as their location. As a UK-based charity, we wanted to assess the largest asset managers worldwide as well as the largest European and, specifically, UK asset managers. We therefore capped the number of managers from North America at 25 to allow other regions to be included (Table 7, Figure 6).

We excluded companies that present themselves as holding companies or umbrella organisations for independent and self-contained asset management subsidiaries.

Figure 6: Number of asset managers and total AUM across regions

The survey consisted of 107 questions across five thematic sections: stewardship, governance, climate, biodiversity, and social issues. The sections and questions were broadly consistent with our 2020 Point of No Returns survey, which was mapped to the structure of the TCFD recommendations. This year, we increased the breadth and depth of questions in key areas across all sections, reflecting our raised expectations. These areas included net-zero targets, areas of global biodiversity importance, and public health considerations.

We prefilled core questions in each section of the questionnaire for each asset manager using publicly available information. We sent this pre-filled questionnaire to the selected asset managers and 83% (64 out of 77) responded directly to verify and supplement answers.

Thirteen asset managers chose not to participate. This is largely due to the expanded number of Asia Pacific managers included in this year’s survey. In these cases, we completed their questionnaire based on publicly available information and provided them with a further opportunity to review this, though none chose to do so.

We collected information from July to November 2022.

The full survey questionnaire can be accessed here.

How asset managers were rated and scored

Scores were assigned to answer options within the survey, with some questions having a larger weighting, and some being unscored. The weight of individual sections was determined by the sum of the scores assigned to each question in that section (Figure 7).

Data auditing was carried out thematically, to ensure consistency of scoring across all questions for all asset managers. In a small number of specific circumstances, we made minor adjustments to the scores. These were: a) to compensate fixed income specialists without equity holdings, and b) to compensate asset managers who were not able to verify questions about information which could reasonably be expected to not be publicly disclosed. Our survey structure also accounted for differences in regulatory contexts.

Figure 7: Score weightings across different sections of the questionnaire

After each asset manager was allocated an absolute score, rating bands were calculated relative to peers based on the number of standard deviations from the mean score. Each participant was assigned a rating applicable to their aggregated score, from AAA through to E.

This year we did not award any AAA ratings, as no asset managers were found to demonstrate leading practice throughout their entire approach. Examples of leading practice on specific topics are given throughout the report to illustrate our expectations for asset managers on the issues covered by this survey.

Acknowledgements

The questionnaire was developed with input from external experts; we are very grateful for their help. We especially wish to acknowledge the help of:

Andrea Prada Hernandez, Jakob Mayr and Richard Cardenaz Dominguez (WWF), Catherine Bryan (Synchronicity Earth), Felicia Liu (University of York, Department of Environment and Geography), Janet Williamson (TUC), Kevin Chuah (Northeastern University), Monika Freyman (Addenda Capital) Sara Heinsbroek (VBDO), Will Martindale (Cardano), and others who wished to remain anonymous.

References

[i] IPE (2021). Top 500 Asset Managers. IPE International Publishers Ltd. Available online at: https://www.ipe.com/reports/top-500-asset-managers-2021/10053128.article [accessed 27 January 2023].

Disclaimer

Authors: Abhijay Sood, Dr Jonathan Middleton, Marina Zorila

Contributing Authors: Dr Claudia Gray, Danielle Vrublevskis, Felix Nagrawala, Izzy Monnickendam, Katie Stewart

Contact: research.secretariat@shareaction.org

ShareAction gratefully recognises the financial support of the Stichting Foundation for International Law for the Environment, IKEA Foundation, KR Foundation, and the Sunrise Project towards the work that contributed to the research, writing and publication of this report.The views expressed are those of ShareAction.

ShareAction would like to thank the reviewers who provided comments and suggestions on the report: Aidan Shilson-Thomas, Catherine Howarth, Charlotte Lush, Ellie Oriel, Eve Gleeson, Fergus Moffat, Ignacio Vazquez, Isabella Salkeld, Isobel Mitchell, Jana Hock, Jeanne Martin, Jess Attard, Dr Katie Leach, Maria van der Heide, Dr Martin Buttle, Niall Considine, Peter Uhlenbruch, Rachel Hargreaves, Rachel Haworth, Sam Coates, Stuart Laidler, and Xavier Lerin (all ShareAction), and Kevin Chuah (Northeastern University).

ShareAction does not provide investment advice. The information herein is not intended to provide and does not constitute financial or investment advice. ShareAction makes no representation regarding the advisability or suitability of investing or not in any particular financial product, shares, securities, company, investment fund, pension or other vehicle, or of using the services of any particular organisation, consultant, asset manager, broker or other provider of investment services. A decision to invest or not, or to use the services of any such provider should not be made in reliance on any of the statements made here. You should seek independent and regulated advice on whether the decision to do so is appropriate for you and the potential consequences thereof. While every effort has been made to ensure that the information is correct, ShareAction, its employees and agents cannot guarantee its accuracy and shall not be liable for any claims or losses of any nature in connection with information contained in this document, including (but not limited to) lost profits or punitive or consequential damages or claims in negligence.

Fairshare Educational Foundation (t/a ShareAction) is a company limited by guarantee registered in England and Wales number 05013662 (registered address: Runway East, 2 Whitechapel Road, London, E1 1EW, UK) and a registered charity number 1117244, VAT registration number GB 211 1469 53.