Introduction

Last year we published detailed research (Point of No Returns 2023) showing that asset managers did not have the policies in place to deal with their environmental and social impacts. They also weren’t taking effective steps to address the business risks posed by these impacts Since then, asset managers have faced a backlash, particularly in the US, as fossil fuel look to counter a growing climate movement. It’s vital that asset managers continue to show the ambition the planet needs.

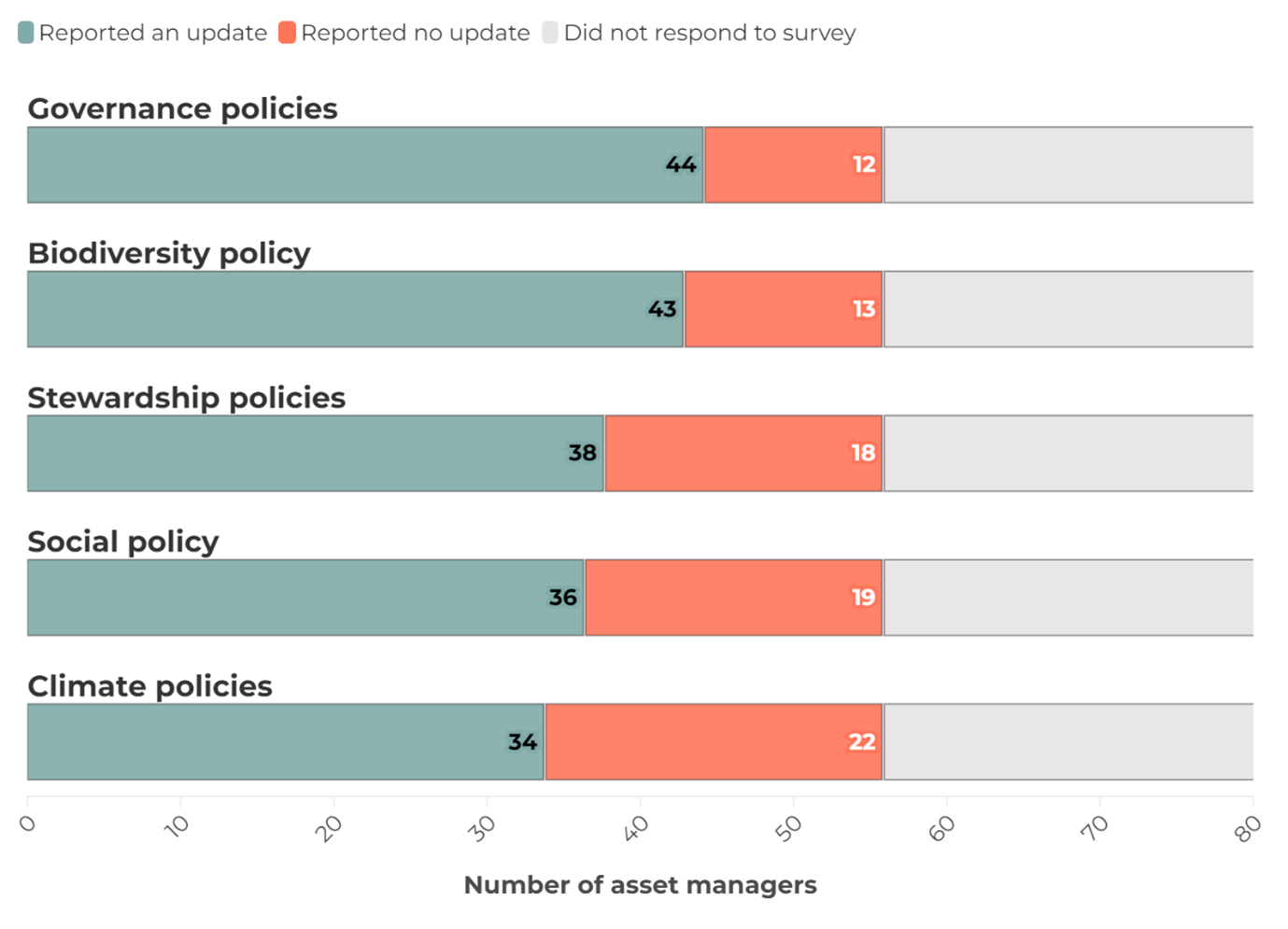

We recently asked asset managers who took part in our ranking if they’d updated their policies over the last 18 months.

The data discussed below is self-reported by participating asset managers, and measures whether or not they have updated their policies, not the content of those policies themselves.

56% of the 77 asset managers in our 2023 benchmark responded to our short survey.

70% came from European asset managers, with performers who did well in our 2023 benchmark overrepresented. Just under three quarters of these received a grade of C or above in the benchmark.

Most asset managers say they have updated their policies

The majority of asset managers reported to have updated their policies in some way. Updates relating to governance and biodiversity were the most popular, at 79% and 77% of respondents respectively. Social and climate policy updates were rarer, at 65% and 60% respectively. The most popular changes related to training, with 42% claiming to have implemented compulsory training for responsible investment. 33% said they provided voluntary RI training.

Nearly four in five asset managers said they updated their biodiversity policies

After governance, biodiversity policies were updated by more asset managers than any other area of responsible investment. The most common biodiversity update was on how managers engage with companies they invest in to drive change, representing 60% of respondents.

Around one in three asset managers said that they had updated their impacts and dependencies assessments – how their business affects nature and how it relies on it. For example, BNP Paribas estimated the potential deforestation and conversion of natural ecosystems, in hectares, linked to a sample of its corporate holdings’ production and consumption of forest and ecosystem-risk commodities. Columbia Threadneedle also told us they had used the ENCORE tool to assess biodiversity risk across sectors.

This uptick in activity on biodiversity likely reflects the greater focus on nature among financial institutions in the last 18 months, including new sector frameworks for disclosure, new studies showing just how damaging nature loss could be for the economy, and guidelines for how to integrate nature into climate policies and transition plans.

Over a quarter of respondents had not updated their fossil fuel investment restrictions, and do not plan to

Unlike biodiversity, fewer asset managers updated their fossil fuel policies. 30% said they had not updated their fossil fuel investment plan since 2022, and don’t plan to. Of these 13 asset managers, our 2023 benchmark showed that 11 had not committed to restrict investment in the most harmful fossil fuels across all funds. With the window to stay under 1.5C of global warming rapidly shutting , it is alarming that these asset managers with poor policies have no changes planned.

Some asset managers said they’d updated their policies. Eight reported tightening existing thresholds in their policies, in theory increasing the number of fossil fuel companies that could be excluded based on revenue or production thresholds, or the location of their operations. These stronger policies should be the rule, not the exception, for all asset managers.

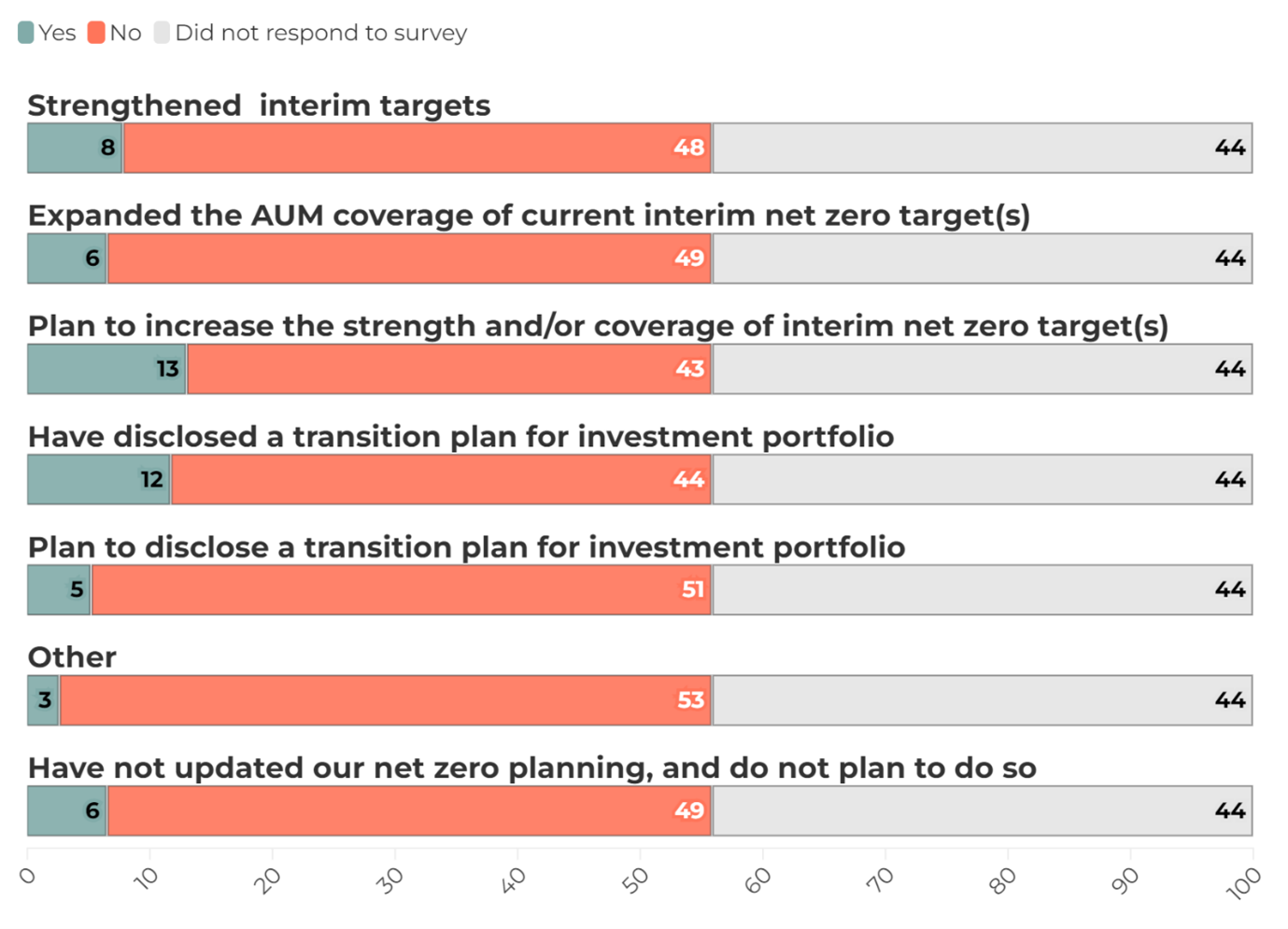

Most asset managers are not updating their interim net zero targets or transition plans.

Setting net zero targets, and publishing transition plans to meet such targets, are a key part of an asset manager’s climate policies. The majority of respondents to this survey did not update the strength or the proportion of assets covered by their net zero targets. In 2023, eight asset managers told us that they planned to set interim net zero targets. Only one of these, T Rowe Price, told us in our recent short survey that they had subsequently published an interim net zero target – committing to a portfolio coverage target of “50% of committed AUM to be considered net zero or aligned by 2030 on the condition that it aligns with fiduciary duty”.

Worse, on transition plans, just 10% of the 30 respondents to our survey who did not have a transition plan at the time of the 2023 benchmark reported to have published once since. All three that reported to have updated their transition planning – including MN and Swisscanto (as part of Zürcher Kantonalbank) – are European. This may reflect the European Commission’s growing scrutiny of the industry, and increased availability of credible transition planning frameworks.

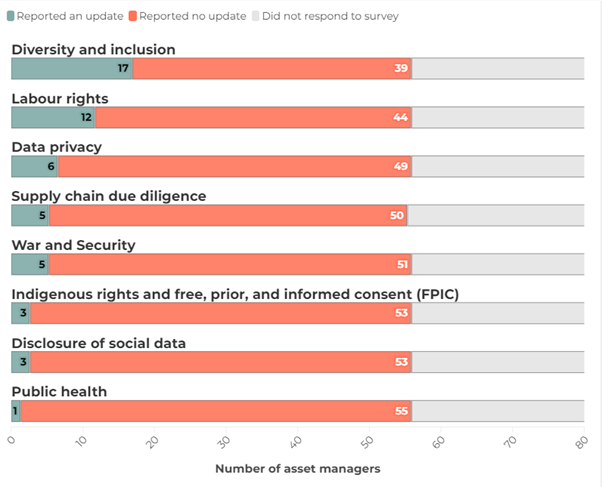

Nearly two-thirds of respondents reported updating their social policies, though there are still important gaps

In addition to environmental impacts, asset managers must also consider the social implications and risks to their investments. This short monitoring survey shows that although asset managers are updating their policies in particular areas, such as diversity, equity and inclusion, topics such as indigenous rights are not being considered.

65% of respondents reported updating their responsible investment policies on social issues. The most popular topic was diversity and inclusion, with 13 asset managers (30%) updating their policies. Within this 13, five did not update on any other social topic. The least-updated topic was public health, with only one asset manager reporting a change. However, the majority of these asset managers already had an investment policy on public health in the 2023 survey.

Only two asset managers updated their policy on Indigenous Rights and ‘Free, Prior and Informed Consent’ (‘FPIC’), a policy which seeks consent from indigenous peoples for any activities on their land. 95% of the respondents to our survey have not yet updated their policies on the topic. FPIC is not only vital as a human right for indigenous people, but also helps safeguard biodiversity. It is worrying that so few asset managers have taken this into account.

Two-thirds of asset managers updated their policies related to engagement with the companies in which they invest.

The majority of asset managers (67%) reported to have updated their stewardship policies – or how they engage with companies they invest in on their social and environmental impact. These tended to focus on escalation – where more serious actions are taken when companies fail to act. 53% updated their escalation policies and disclosure on escalation. As we’ve argued before (RISE paper), establishing a time-bound escalation framework and reporting on its use is critical for ensuring that engagement drives change.

Examples of asset managers that have updated their escalation framework Include Eurizon, which has added a time-bound element to its escalation policy.

Fewer asset managers (30% of respondents) updated the expectations that they hold for companies in engagements. One example is Nordea Asset Management, which published the specific criteria it holds to assess the Paris alignment of companies in sectors that cause the greatest climate damage. LGIM showed evidence of their framework in action, adding an additional two companies in June 2023 to its divestment list under their expanded Climate Impact Pledge engagement programme. MN has now divested from 40 energy sector companies after two years of engagement as a result of these companies’ failure to publicly commit to net zero, and to disclose sufficiently clear and transparent transition strategies supporting their ambition.

Conclusion

Whilst some asset managers are updating their policies on biodiversity, stewardship and some social issues, climate momentum has slowed at the same time as increasing global temperatures wreak havoc around the world . Robust policies preventing investment in the most damaging fossil fuels, combined with effective transition plans, are as critical as ever to tackle the huge challenges we face. Asset managers should review their policies to ensure that they continue to be both relevant and proportionate to the multiple environmental and social crises that face us today.

We’re publishing our next asset manager benchmark in 2025, which will take an in-depth look at asset manager policies and provide clear recommendations for asset managers to achieve truly responsible investment.