This Living Wage Week, the cost-of-living crisis is still hurting working people across the UK. Sixty percent of low-paid workers have used a food bank in the past year. Thirty nine per cent are falling behind on household bills and regularly skipping meals for financial reasons. The crisis has intensified disparities in income and wealth that have been building since 2008, and deepened existing inequalities in the UK economy. In this context, ensuring everybody receives a wage that meets their everyday needs has never been more important.

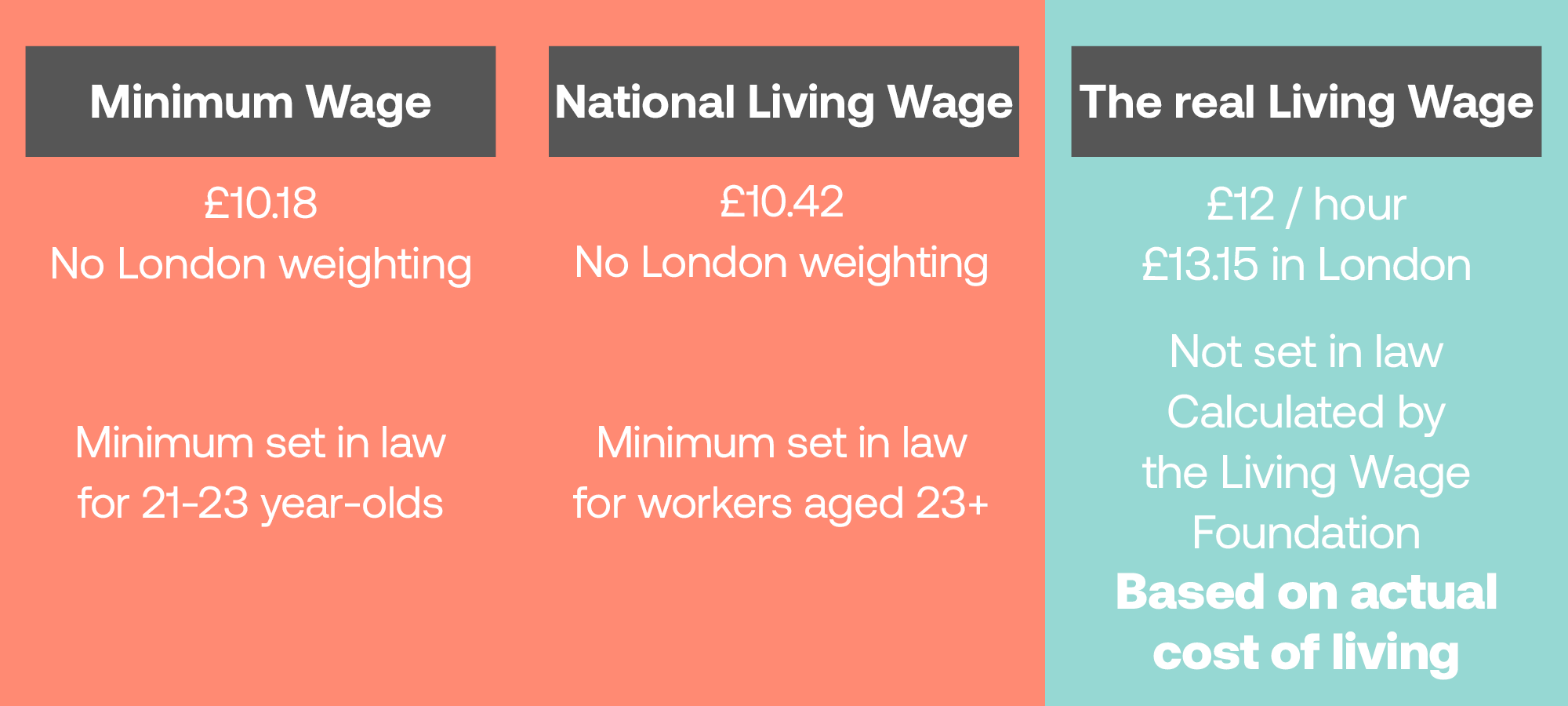

The real Living Wage - as calculated by the Living Wage Foundation - is now £12 and £13.15 in London. This is different and higher than the National Minimum Wage (under 23s) and the National Living Wage (over 23s), which are statutory minimums set by the Government.

The difference between Minimum Wage, National Living Wage, and the real Living Wage.

This Living Wage Week, we are calling on investors to use their stewardship power so that all workers receive the real Living Wage. We must protect our lowest-paid workers in the face of rising costs - both to improve living standards and to address the systemic risks posed by rampant income inequality. Paying the real Living Wage is vital to protect living standards for low-paid workers and serves the long-term interests of businesses, investors, and society.

Firstly, and most importantly, a Living Wage helps working people. This elevation in pay ensures workers can meet their everyday needs, from housing to food to bills, without the anxiety often associated with financial insecurity. With a Living Wage, workers can participate more fully in society, engage with their communities, and nurture a pride in their work. Without a Living Wage, the issues of income inequality and in-work poverty are exacerbated.

Research suggests that the systemic issues of income inequality and in-work poverty pose a risk to society and economy

Nearly all Living Wage accredited employers in the UK have said that paying their workers a better wage has improved their reputation; and two-thirds have said it helps differentiate them from others in their industry and has improved their recruitment processes. In the medium to long-term, these companies will also benefit from a stronger economic environment. This is particularly relevant to companies in the retail and hospitality sectors, where low pay is contributing towards high turnover rates and low productivity.

Research suggests that these systemic issues of income inequality and in-work poverty pose a risk to society and the economy. Low pay stifles consumer spending, a key driver of economic growth, as workers have less disposable income to inject back into the economy. This is worsened by demotivated workforces, reduced productivity, and an increased strain on social welfare systems. In turn, this contributes to deteriorating market volatility and diminished economic output. When combined with deep income inequality, the resulting economic uncertainty can generate social discontent, risking erosion at the very foundation of society and economy.

Investors with diversified portfolios are exposed to this risk. New research published by The Shareholder Commons demonstrates that a diversified portfolio’s value is primarily tied to the health and success of the wider economy, not individual company performance. To demonstrate, a 1% increase in income inequality in OECD countries can lead to a decrease in GDP by 0.6% to 1%. Investors with diversified portfolios should steward the companies they are invested in to protect their overall market returns, even if that stewarding harms the short-term value of that company. The most effective lever in growing a diversified portfolio’s value is encouraging wider take-up of a Living Wage. Globally, raising incomes to a Living Wage could generate as much as an additional $4.56 trillion in output.

So far, investor engagement with companies has had a powerful impact in raising pay

Fourteen thousand companies, and half of the FTSE100, are accredited Living Wage Employers, with 460,000 workers receiving an uplift. This is strong progress, but we are not there yet.

Now, ShareAction is urging investors to face up to threats posed by income inequality when engaging in stewardship; to alleviate the financial pressures on workers, to strengthen company performance, and to grow portfolio value. Investors who would like to play their part in this bold new approach can do so by joining ShareAction’s Good Work Investor Coalition. Or, if you would like to donate to support ShareAction's work, you can do so here. Together, we can create a system built on decent work, shared prosperity, and social cohesion.