The insurance industry plays a critical role for the global economy, and therefore for people and planet. It enables nearly every other sector to operate — from energy to agriculture to transport — by providing the safety net that keeps risk manageable and money flowing. But insurers don’t just react to risk; they shape it.

By deciding which projects to underwrite and where to invest, they can accelerate the transition to a sustainable future — or entrench the very systems driving the climate crisis, biodiversity loss, and social instability.

In April 2024, Shareaction published Insuring Disaster, our third benchmarking report of global insurers. We found poor performance throughout the industry on key climate, biodiversity, and social issues, with almost half of the insurers assessed receiving the lowest grades available.

In our report, we provided clear recommendations to help insurers have a more positive impact on people and planet. We followed up with the insurers featured in the survey in May 2025, asking them whether they had implemented any of these recommendations.

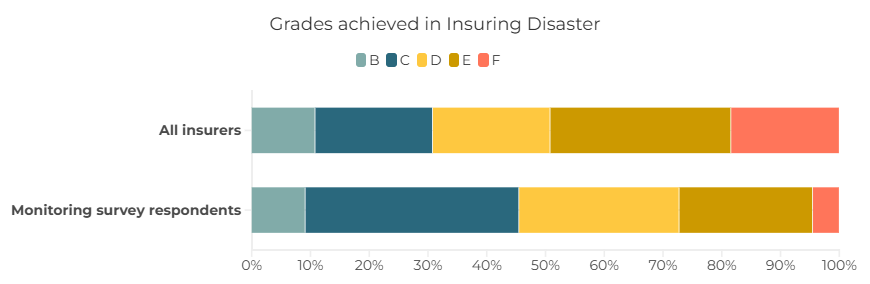

22 of the 65 insurers featured in the original survey responded. The chart below shows the grades achieved by insurers which responded to the survey compared to the overall Insuring Disaster sample. Insurers which performed better in our assessment were more likely to respond, as were those based in Europe.

Figure 1: Respondents to the monitoring survey tended to perform above average in the Insuring Disaster ranking

What did we learn?

Over a quarter of the insurers in Insuring Disaster have taken our recommendations on board.

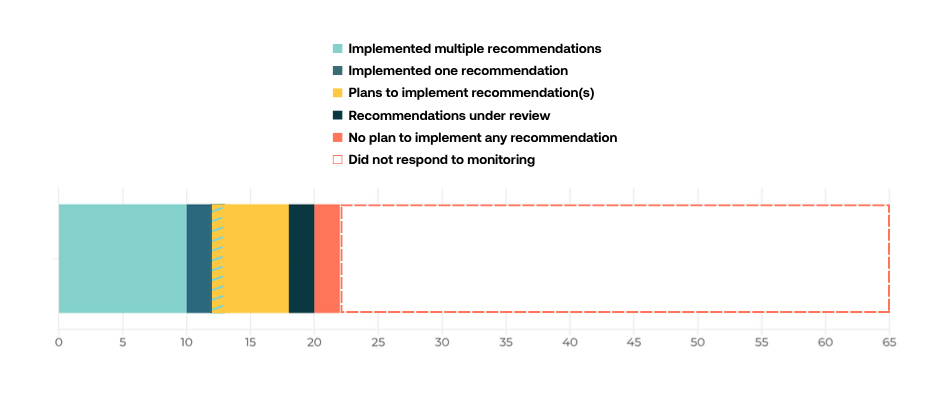

Of the 22 respondents, 18 insurers reported either implementing or planning to implement at least one recommendation from the Insuring Disaster report. This accounts for 82% of the insurers which responded to the monitoring survey, and 28% of the insurers featured in our assessment. While there may be other instances of our recommendations being implemented among the insurers who didn’t respond, this self-reported sample suggests significant uptake of our recommendations and that our benchmarking continues to play an important role in shaping industry behaviour.

11 of those 18 insurers stated that they had implemented multiple recommendations made in the report. One of these insurers additionally stated that they planned to implement further recommendations in future, with five other insurers also planning to do so. Two insurers reported that they had already implemented one of the survey recommendations.

Figure 2: Over half of respondents have implemented at least one recommendation, and more plan to in future

However, recommendations across themes were not implemented equally and critical areas are being neglected.

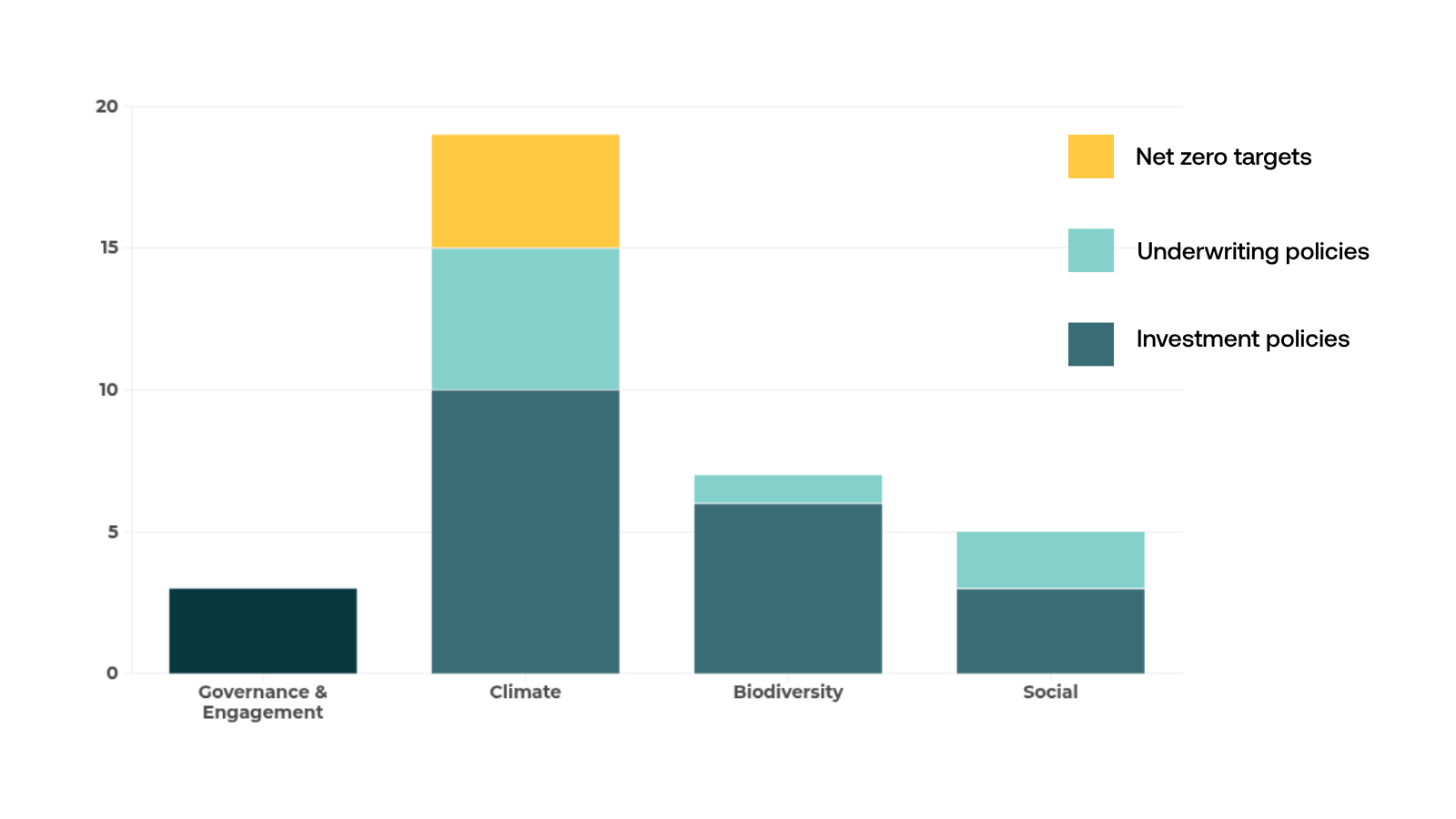

We found that our climate recommendations accounted for half of all which insurers had implemented so far. Although Insuring Disaster signalled a need for improvement across all themes, insurers performed best on climate on average.

While it is positive that insurers are implementing recommendations on climate policies and net-zero targets, the blind spots we identified on biodiversity, social, and governance issues are still not being addressed. Financial institutions, including insurers, often cite a lack of robust data and guidance as explanations for their lack of progress in areas other than climate. However, we have consistently found that many fail to engage with the resources available to them and highlight insurers demonstrating leading practice which others can emulate.

Similarly, insurers were more likely to implement recommendations in their investment policies rather than their underwriting policies.

How insurers choose to invest the vast amounts of money in their reserves has major impacts on environmental and social issues. But implementing underwriting policies which account for and minimise harm to people and planet is vital to mitigating the negative impacts of the insurance industry.

If insurers are willing to provide underwriting services for oil and gas expansion, plantations causing deforestation or damage to ecosystems, companies which violate the rights of Indigenous peoples, or any other damaging activities, their responsible investment commitments risk being undermined and ineffective.

Insurers that want to take their impact on people and planet seriously need to act urgently on their underwriting practices and address the major facilitating role which they currently play in environmental and social decline.

Despite this, responding insurers reported just eight instances of implementing underwriting recommendations. Underwriting policies were already found to be weaker across all themes in the Insuring Disaster report, suggesting that insurers are neglecting to act on the most impactful and critical elements of their business.

Figure 3: Investment and climate-focused recommendations have been implemented most often

We remain committed and positioned to drive up ambition in the industry.

Through our work analysing, ranking, and engaging with insurers, we will push to keep environmental and social impacts firmly on their radars. According to them, Insuring Disaster did just that.

All 22 of the insurers that responded to the survey said that they found the report helpful and 68% reported that their senior leadership had read or been briefed on the report or ranking. Insurers found our personalised feedback documents and leading practice examples particularly useful.

The monitoring survey showed some promising pockets of progress, but also a need for greater focus among insurers to ensure that they address the issues raised in Insuring Disaster. With work now underway on the next iteration of ShareAction’s insurance benchmark, we’re calling on the insurance industry to address its impacts on climate change, biodiversity loss, and social issues.

The need for action across the board is greater than ever, and these powerful institutions have a choice to make – will they continue to enable environmental and social decline, or will they take action to tackle the serious risks threatening people and planet?