On 5th June 2025, the Pension Schemes Bill was introduced. The Government promised it would introduce a historic overhaul of the pensions system, with the aim of boosting pension savings and driving growth in the UK economy. However, as yet, the Bill has a way to go to truly ensure the system considers the longer-term impacts on people and planet as well as short-term financial returns.

ShareAction has campaigned for many years for the clarification of the rules pension scheme trustees need to follow when managing the money invested via our pensions (also known as fiduciary duty). We believe in this so strongly that we drafted an amendment to the Pension Schemes Bill in the hope of changing the law.

On Tuesday 21st October, Liam Byrne MP tabled our amendment to the Bill, which was a huge win. This means our suggested changes will be discussed by MPs as they develop the Bill. Although the amendment has been tabled, it must gain sufficient support from MPs and later, the House of Lords, to ensure it will be included in the final version of the Bill.

What is fiduciary duty?

Fiduciary duty is the legal responsibility that pension fund managers have when they’re in charge of someone else’s money. It means they must always act in the best interests of the people whose money they manage, not in their own interest.

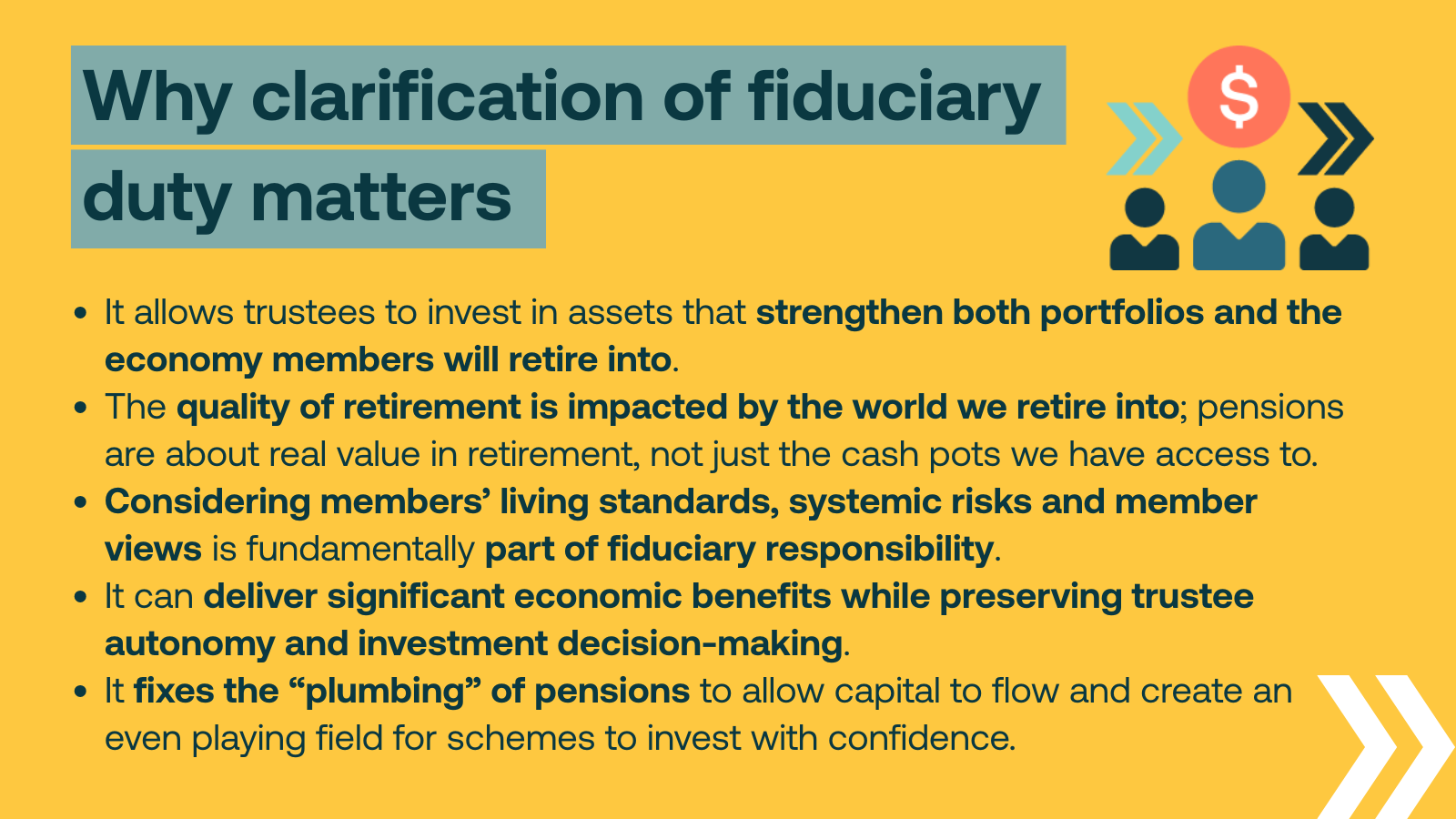

Why is the amendment important?

The current law on pension scheme trustees’ fiduciary duties is not clear. This makes it hard for pension schemes to be confident they have a legal basis for looking at investment issues that can have wider impacts, such as investing in the UK economy, health and the environment.

The Government wants to drive growth into the UK economy and has introduced instruments like the Mansion House Accord, which invited pension schemes to become voluntary signatories and invest up to 5% of their portfolios in the UK economy by 2030. A change in the law would not just enable the largest schemes with significant resources to invest in the UK, but all schemes would have the legal backing to invest in UK-based initiatives. This would benefit savers themselves, local economies and better reflect UK pension savers’ views.

What happens next?

We are galvanising the support of as many MPs as possible for our amendment and we hope to see it discussed by the end of November. We will then gather support in the House of Lords to ensure the amendment is passed by the Peers. The Bill will go to ‘Ping-pong’, which is when a Bill passes back and forth between both Houses until it is agreed upon, including all suggested amendments. We hope our amendment will be included in the final version and this will change pensions legislation for the better.

We will keep our supporters updated as and when we know more. Sign up to receive our newsletter here.