(Thursday 11th December) Today, detailed analysis of Europe’s 25 largest banks from responsible investment NGO ShareAction finds progress on climate action has ground to a halt, and in several cases moved backwards. Banks are failing to meet the growing challenge of the climate crisis, whilst extreme weather drives up food prices, damages homes and infrastructure and increases health risks across the continent.

The report assessed the banks’ approaches to tackling climate change as well as protecting natural habitats around the world and respecting the rights of indigenous communities on the front lines of the climate crisis. It found that whilst a small number of banks continue to set new targets to cut emissions in key sectors, the overall picture is one of weak fossil fuel policies and declining ambition.

Notably, HSBC, NatWest, Santander and Nordea have weakened commitments to shift capital away from high-polluting clients, and banks recently voted to shut down the world’s largest climate finance alliance, signalling a worrying step away from action to curb dangerous global heating.

Some of the key findings of this edition of ‘In Debt to the Planet’ include:

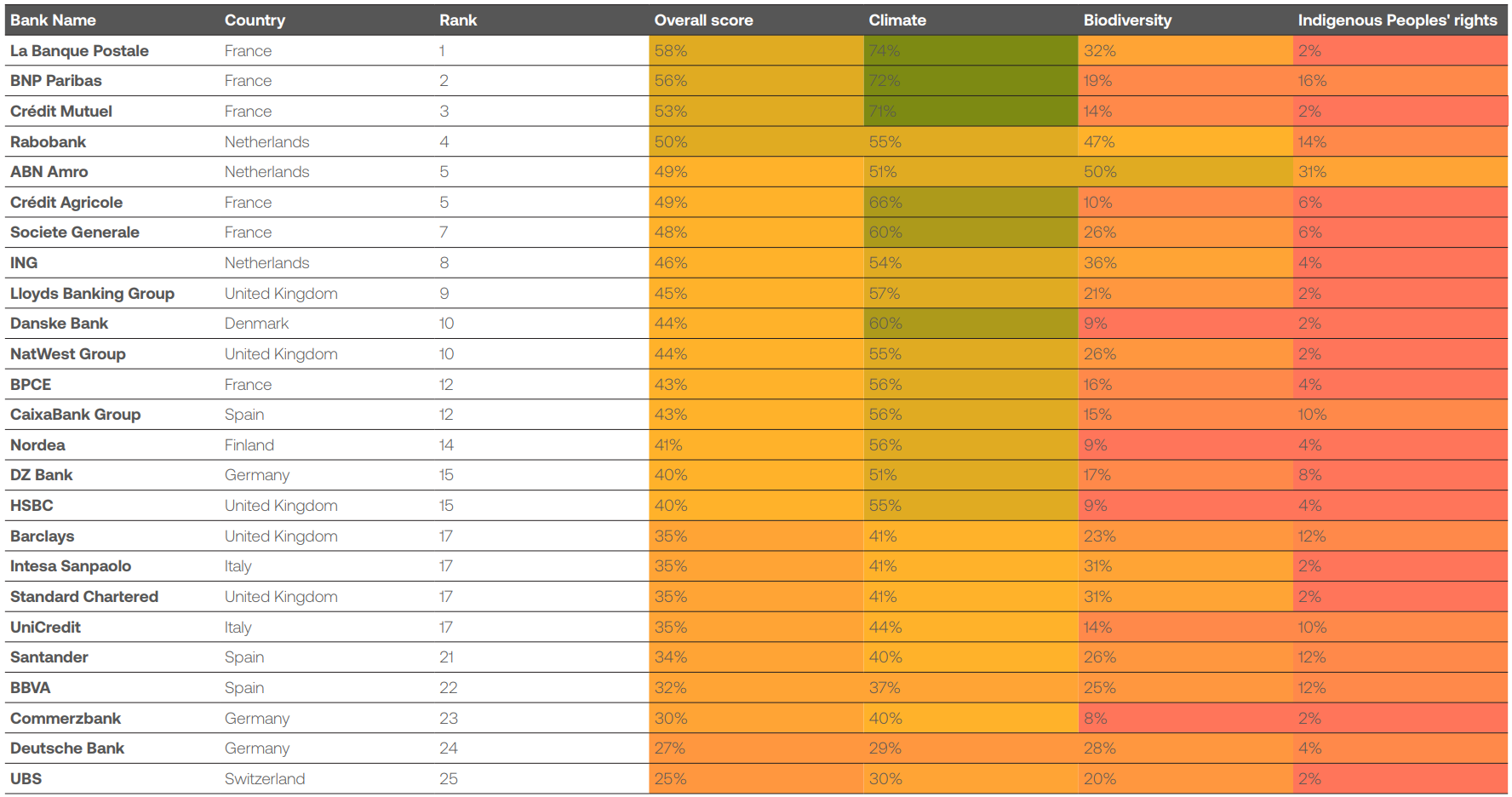

- Banks are failing to take the necessary steps to address pressing environmental and social risks. Only BNP Paribas, Crédit Mutuel, La Banque Postale and Rabobank scored above 50%. UBS (25%) and Deutsche Bank (27%) ranked lowest. The average score across all 25 banks was just 41%.

- Fossil fuel policies remain far from aligned with climate science. Despite the International Energy Agency (IEA) finding that a faster clean-energy transition will reduce costs for consumers, only four banks fully exclude financing for companies pursuing new oil and gas projects — a critical threshold for limiting dangerous global heating.

- Expansion of fossil fuel infrastructure remains largely unchecked. Just four banks rule out finance for liquefied natural gas (LNG) terminals, despite the risk of these becoming a bad investment and IEA warnings of an oversupply of natural gas. Fewer than half have restrictions on financing pipelines or other oil and gas infrastructure.

- New sustainable finance targets show declining ambition. Five banks that have adopted new sustainable finance targets since May 2024 have scaled down in ambition. These banks could meet their goals even while providing less sustainable finance each year.

Commenting on the findings, Xavier Lerin, Head of Financial Sector Research at ShareAction said:

“Communities across Europe are already living with the realities of climate change. More frequent heatwaves, droughts and floods are affecting what people pay for food, their health, and the safety of their homes.

“Banks have a crucial role to play in steering the economy through the challenges being thrown up by the climate crisis. Yet instead of leadership, most banks are slowing down their progress on climate and a concerning minority are even backsliding on commitments.

“If banks continue on this path they are not only exposing communities to harm – they are also storing up major financial instability for the years ahead. Investors must step up pressure on banks and use every available lever to ensure climate risk and the enormous financial and human costs of runaway global heating are properly managed.”

The report also calls on regulators to address the slow, uneven progress on regulation that hardwires climate responsibility into banking operations. This could be done by requiring banks to publish credible

transition plans and updating capital rules to reflect the high-risks of fossil fuel investments.

Recent studies have shown a significant public mandate for action from governments on climate, with 89% globally demanding greater political action.

Table 1: Ranking of Europe’s largest banks based on their performance on key environmental and social issues

ENDS

Notes to editors

The full report and information on the methodology can be found here.

Briefings for UK and EU policymakers around the findings of the report can be found here and here.

Information on ShareAction’s 2022 ranking can be found here.