(Thursday 23rd September, London) The vast majority of UK sales (71 per cent) from 16 of the world's largest manufacturers of packaged food and drink products stem from unhealthy products (less than 3.5 stars in the Health Star Rating system).

Despite growing pressure on food companies to improve their impact on public health, six of the sixteen companies - Ferrero, Suntory, Mondelēz, Unilever, Coca-Cola & Nestlé – continue to derive 80 per cent more of their UK sales from unhealthy products.

The findings come from a study conducted by the Access to Nutrition Initiative (ATNI), supported by ShareAction. It tracks the contribution of 16 major food companies to the U.K.'s diet-driven health crisis, analysing the nutritional quality of more than 4,000 products which account for approximately 50 per cent of total U.K. retail sales of manufacturer brands’ packaged food and beverages.

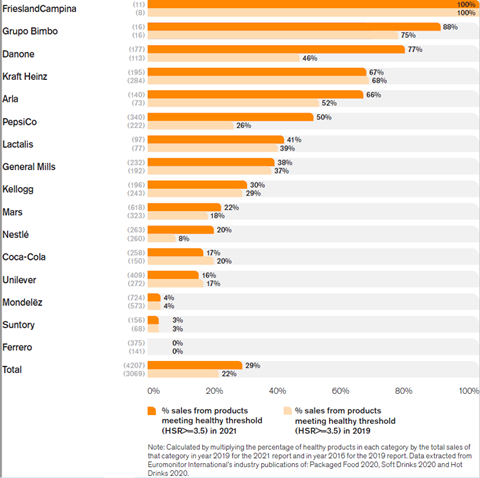

The study did find some progress since its last assessment in 2019, when 78 per cent of sales came from unhealthy products. But that progress is largely down to big improvements from just a few of the largest companies. Danone increased their proportion of healthy sales from 46 to 77 per cent and PepsiCo from 26 to 50 per cent.

There was little change elsewhere in the percentage of sales from healthy products, with Kellogg, Unilever, Coca-Cola, Mondelēz, Suntory and Ferrero all stagnant or in reverse.

Inge Kauer, Executive Director of the Access to Nutrition Initiative, said:

"It is encouraging to see that nine companies have improved the healthiness of their portfolios and that overall sales from healthy products increased from 22 to 29 per cent. This shows that, even within a relatively short period of time, manufacturers can make progress through measures that introduce more healthy varieties in their portfolios.

However, the average healthiness of product portfolios by some of the largest manufacturers selling in U.K. remains concerning, with a mean Health Star Rating of 2.2 out of 5 stars. Poor diets remain the biggest risk factor for preventable ill health in the U.K. and consumers need easier access to affordable, healthy diets to fight this. I call on companies to step up their efforts and to urgently commit to improving the nutritional quality of their product portfolios in the U.K. and beyond."

Junk food in the spotlight

Everyone has the right to access the nutritious diets they need to live healthy lives, but the ern food environment makes this more challenging than ever. We live in an environment that floods people with opportunities and incentives to eat more unhealthy foods. Many families simply can’t afford to provide their children with healthy options, as food producers prioritise the manufacture of low-cost, highly processed products.

The most recent Global Burden of Disease report found that poor diets were responsible for 22 per cent of all deaths among adults in 2017, with cardiovascular disease (CVD) as the leading cause, followed by cancers and diabetes.

The UK’s National Food Strategy (NFS) says the UK is now the third most overweight country in the G7, with almost three in ten of its adult population obese. By 2050, the annual cost of obesity is expected to rise to £9.7 billion for the NHS and nearly £50 billion for society as a whole.

Obesity has also been a major factor in the UK’s tragically high death rate from Covid-19. Severely obese people are 2.25 times more likely to die from Covid, while people with Type 2 diabetes (both controlled and uncontrolled) are 81 per cent more likely to die from the virus. The NFS says that “Even smoking doesn’t come close to doing the same amount of damage” to public health as poor diets.

UK government action

The National Food Strategy set an objective to reduce national consumption of unhealthy (high in fat, salt and sugar) foods by 25 per cent by 2032. And last year the government approved legislation to prohibit price promotions on HFSS foods and restrict their advertising online and before 9pm on TV, which will come into effect in 2022.

Business risk

The ongoing excessive reliance of manufacturers on less healthy products for profit suggests they are largely unprepared for these regulatory changes. ShareAction said companies should start by disclosing their own figures on percentage sales of healthier products (using the UK Government’s Department of Health Nutrient Profiling Model) and setting targets to grow this proportion, in line with National Food Strategy recommendations. This would allow investors to understand how they are managing risk in this area.

The responsible investment NGO, which this year filed a resolution which led to retailer Tesco setting similar targets, said those manufacturers which failed to respond should expect robust engagement from investors in the run-up to the 2022 AGM season.

Jessica Attard, Head of Health at ShareAction, said:

"With the UK’s incoming regulations restricting marketing of unhealthy products, there is a clear business case for faster action by food companies to reduce their reliance on unhealthy products. Investors, including our own Healthy Markets coalition of investors, want to see ambitious action on health from the largest companies and will be looking to hold laggards accountable this proxy season."

Kieron Boyle, CEO of Guys & St Thomas’ Foundation, said:

“While leading manufacturers have increased their sales of healthy foods, the overall picture is of an industry lagging behind. The impact of obesity on a healthier society is clear and investments in unhealthy foods are fast becoming stranded assets. We have seen the UK retail market respond to these issues by setting clear targets to increase their sales of healthy foods. It's now time for manufacturers to do the same."