Workforce Disclosure Initiative: FAQs

About the WDI

The Workforce Disclosure Initiative (WDI) is the only investor-backed platform for disclosure of company workforce data covering both direct operations and supply chains. It is unique in terms of its scope and ambition covering ten workforce management areas – governance, risk assessment, contractual status and remuneration, gender diversity, stability, training, wellbeing and rights issues. The WDI survey applies to all corporate sectors and covers all geographical regions.

Since 2017 the WDI has won the support of 140 institutional investors, established international partnerships in Canada and Australia, and secured new disclosures to the WDI platform from 118 of the largest listed companies worldwide. In its first three years, the WDI has done more to improve corporate workforce reporting than any other comparable framework.

The WDI survey and question guidance is structured in a way to support companies to prioritise their responses and progressively increase the level of workforce data they report as they become more accustomed to responding to the survey. There are three main ways companies can prioritise their response.

Companies should focus on providing data for the Foundation tier questions, which ask for the most basic and commonly reported workforce metrics. Companies should also aim to respond to as many of the Core Indicators as possible, as these ask companies for the data that can be most insightful when looking to improve workforce practices. Lastly, the guidance for each question has been structured to highlight what data can be reported when a company is ‘getting started’ and what would be the more detailed data companies provide as ‘next steps’. Even if the company cannot meet every criteria in the guidance, providing data on just the ‘getting started’ components can help prioritise data collection and responses and establish a foundation for more detailed data in future years.

Organisations that are looking to advance their workforce reporting should aim to complete as many Intermediate tier questions as possible. Companies should also aim to report against all Core Indicators. Companies should also aim to provide more comprehensive data for the questions they are already responding to, for example, by providing data that covers more operating locations and a larger proportion of the workforce. They should be meeting all ‘getting started’ criteria in the guidance for every data point they provide, as well as aiming to provide data for more ‘next steps’ criteria. Organisations should also consider how they can provide more data on topics that are traditionally underreported, such as workforce stability.

Companies that are looking to establish themselves as leaders in workforce reporting should be aiming to provide data for as many Comprehensive tier indicators as possible. These are questions that reflect the challenges of collecting and reporting information on aspects which are often overlooked. Leading companies should already be providing detailed data against all Core Indicators and, wherever possible, providing data that covers as large a proportion of the companies’ operations as possible. Leading companies should also be meeting the majority of all guidance criteria (both ‘getting started’ and ‘next steps’) for each question. In an increasingly competitive and challenging global labour market, the way a company treats and manages its workforce has never been more important to the long-term success of a company. The recent COVID-19 pandemic has only served to highlight this, with companies’ workforce practices facing significant scrutiny as the devastating consequences of the pandemic on workers become clear.

Example question: 2.9 Provide an example of how the company has monitored the effectiveness of actions taken to address negative impacts on the human rights of workers in the reporting period, including by consulting with impacted workers and any lessons learned.

Recommended approach: If the company has never carried out the specific actions a question is asking for an example of, companies can outline the steps and procedures the company would take if they were to take that action, clearly indicating that this is what the company would do, not what the company has done. The company should also explain what plans they have, if any, to take this action in the future.

Example question: 3.3 Provide the number and/or percentage (%) of the company’s employees on each contract type as a proportion of the total direct operations workforce.

Recommended approach: Organisations should provide whatever data they currently have and utilise the ‘notes on this topic’ questions to provide any further context around the data they have provided. Companies should not feel concerned about providing partial data, as even limited data is greatly valued by investors. Providing partial data can also help the company identify where there are gaps in their data collection and opportunities to progressively build upon the information the company already has, helping the organisation improve its own reporting.

Example question: 9.2 Provide the percentage (%) of employees covered by collective bargaining agreements for all locations in the direct operations

Recommended approach: Companies should provide whatever data they have, even if the answer is zero. This is both helpful to investors when looking to understand the company’s approach to workforce management, as well as ensuring the company’s actual level of workforce data is reflected in its disclosure score. A higher Disclosure Score increases the likelihood the company will be eligible for a WDI Workforce Transparency Award.

All questions in the WDI survey have been designed so that companies from every sector can provide at least some data. It is inevitable that certain topics will be more salient for certain companies than for others, but companies should aim, and be able to, provide data for every section of the survey, including the sections on the supply chain. While service-based companies often lack goods-focused supply chains of in equivalent scale to manufacturing organisations, it is extremely unlikely that they will have no supply chain to report on at all, as service-based companies often have supply chains that consist of other services, tools, software and so on.

For organisations with less extensive supply chains, the ‘getting started’ criteria in the guidance can serve as a helpful guide as to the information that may be more appropriate for them to provide. Additionally, as the WDI’s focus is transparency, and not performance, companies will not be penalised for responding to questions with limited data. Where a question asks about supply chain practices that the organisation does not engage in, the company can simply state this.

Even in sectors or organisations where unionisation and collective bargaining are less common, companies should still aim to respond to questions addressing these topics. Collective bargaining is fundamental human right for all workers, regardless of sector, as evidenced by its inclusion in numerous national and international legal standards. Consequently, data on collective bargaining is incredibly important and an area of significant interest for investors, regardless of sectoral prevalence, given its fundamental nature.

The WDI’s focus on transparency, rather than performance, results in the survey being inclusive of companies with a range of approaches to workforce management, and so a lower prevalence of certain practices, such as collective bargaining, should not prevent companies from answering questions on these topics. For example, for question 9.2, a company could simply state that they have 0% collective bargaining agreement coverage across their operations, rather than ignoring these questions.

However, to ensure investors can gain a full understand of how the company engages with workers, companies operating in sectors with low collective bargaining agreement coverage should place a strong emphasis on questions that allow them to demonstrate how they are listening to their workforce, such as Q2.7 and Q9.7, amongst others.

Established with funding from the UK’s Department for International Development (DFID), the WDI is looking to diversify its income stream. Charging a fee to investor signatories as beneficiaries of the programme is essential to this plan.

This process was accelerated by changes within the UK government and the end of the Responsible Accountable and Transparent Enterprise (RATE) programme, which is why the WDI is launching an investor fee model now.

The investor fee model would give the WDI stable income and credibility to continue increasing the scale and impact of the initiative.

- Continued participation in the world’s only investor-backed platform for disclosure of comparable direct operations and supply chain workforce data.

- Access to company scorecards for all disclosing companies.

- Access to online data dashboards, increasing the usability of the WDI data.

- Logo on WDI website and other opportunities to raise profile regarding ESG issues.

- Two free tickets to the annual WDI conference. Year-round opportunities to participate in roundtables, workshops and webinars bringing investors and companies together to discuss workforce disclosure and issues.

- New in 2020 – thematic and sector briefings (including analysis of financially material risks and opportunities)

As a collective enterprise, the success of the WDI relies on investor support and engagement with companies. Under the investor fee model, we expect investor signatories to:

- Engage with listed companies both individually and collectively and encourage them to disclose workforce policy and practice data to the WDI.

- Engage with listed companies both individually and collectively to encourage increased public disclosure of workforce policy and practice data.

- Report back to ShareAction and other WDI signatories the outcomes of engagement with companies through the investor data-site.

- Steward investee companies to encourage improved workforce policies and practices which will lead to better jobs in direct-operations and in supply chain.

- Champion WDI in public with other non-signatory investors and non-disclosing companies.

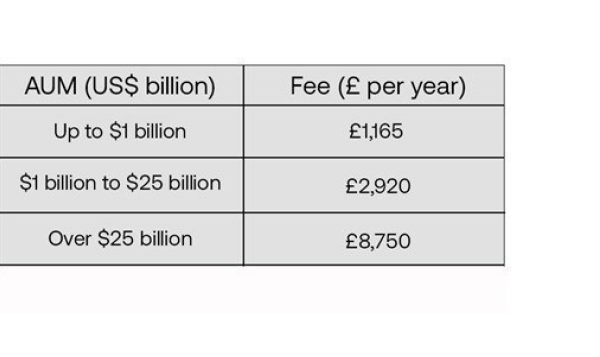

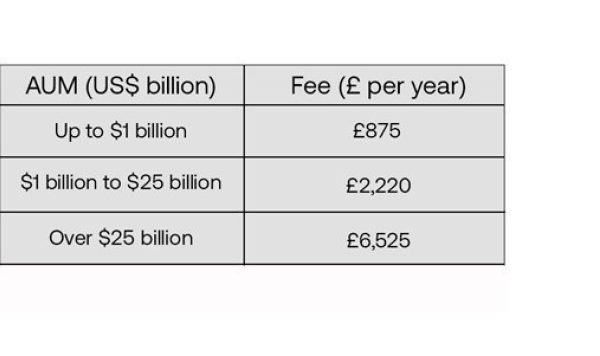

The “investor fee model” will call for a contribution from investor signatories based on total assets under management (AUM). Fees will be distinguished across three bands based on the size of your company.

All fees payable are exclusive of VAT.

Asset Manager

Asset Owner

ShareAction will send an invoice on 1 April, we would like it to be paid within 60 days.

No.

Investor signatories will fund a proportion of the WDI team and process. This is to reflect the value that signatories gain from the initiative. The WDI will continue to seek funding from governments, philanthropic organisations and through partnerships.

No.

We are committed to increasing public disclosure of workforce data long-term. The investor fee will fund a proportion of the WDI team and process. It is not a fee to access the data.

Over the short-term, fee-paying investors will have access to some data not disclosed publicly by companies. We have found that giving companies the option to disclose some information only to investor signatories is crucial to increasing the overall number of companies participating in the WDI. We make the public/signatory-only disclosure options clear to companies when they participate in the WDI. We will continue to allow this when the investor fee model is established.

We have already taken important steps to promote more public disclosure to the WDI. In 2019, we included a range of mandatory public questions in the survey. If companies provided responses to these questions, they had to make the data publicly available. It is through steps like this that we will continue to demonstrate our commitment to driving workforce data into the public domain over the medium to long-term.

The number of companies disclosing to the WDI has grown from 34 to 173 over the course of 5 years. In 2022, we will re-double our efforts to increase the number of companies responding by:

- Capitalising on constructive relationships built with over 500+ companies over the first 5 years of the WDI.

- Stepping up efforts to coordinate investor signatories to use WDI data in their engagements with companies, increasing the collective investor demand for better workforce data.

- Increasing our concerted efforts to grow our presence in US.

- Investing resource to refine the WDI survey and online disclosure platform with the purpose of making it as smooth as possible for companies to provide data.

ShareAction's board have decided to establish a process to transition the WDI to operational independence. We anticipate it will take around two years for the WDI to become a standalone, independent entity.