For Doris Chauca, a cleaner from London, that expectation is personal. After years of working long hours on low pay, she now earns the real Living Wage – enough to cover her basic needs and plan for the future. “Being paid a real Living Wage, having stable hours, and respect in your profession – that's what makes a difference,” she says. Doris’s story shows what fair pay really means in practice: greater stability, dignity, and the chance to live – not just get by. You can read more about Doris’s story here.

Polling, commissioned by ShareAction and conducted by Survation, has revealed that people – as both consumers and pension savers – want retailers to pay their staff a real Living Wage. And they’re willing to act when companies fall short.

What the Public Thinks

The polling shows overwhelming backing for fair pay. An incredible 88% of people said it’s important that employers pay the real Living Wage, the only UK wage rate based on the actual cost of living. This widespread support underlines how deeply the issue of low pay resonates with the public, setting the stage for action from both companies and investors.

Two-thirds of people (67%) believe that cleaners, security guards and other contracted staff in retail stores should also be paid the real Living Wage. This matters because these third-party contractors, workers hired by a company to perform a specific service under a contract, rather than being a direct employee, are often the lowest paid in the industry and are left out of company-wide commitments to better pay and conditions. Like Doris, these are the workers who keep our shops running every day. Ensuring they are paid fairly is fundamental to building a more equal economy and society.

The public also expressed concern about the growing gap between those at the top and bottom of companies. Nearly seven in ten people (69%) said it’s unacceptable that CEOs of major retailers earn 100 times more than their lowest-paid staff. It’s a striking figure that highlights a deep discomfort with the widening inequality seen today. The High Pay Centre and 20 leading academics have recently warned against excessive executive pay, suggesting extreme pay ratios damage employee engagement, productivity and ultimately business performance. The message from the public is also clear: fair pay isn’t just about raising the floor, it’s also about narrowing the gap between those at the top and those at the bottom.

These views are already shaping both consumer and investor behaviour. Earlier this year, ShareAction coordinated shareholder resolutions at JD Sports, Marks & Spencer, and Next, calling on these retailers to tackle low pay and be transparent about how they treat their staff. Resolutions are one of the most powerful campaign tactics. We use the power of individual shareholders to put a formal vote on the agenda at the AGM of companies.

The results were striking: 30.7% of investors at M&S, 26.9% at Next, and 13.7% at JD Sports backed the resolutions – rising to 34% among independent shareholders when JD Sports’s majority owner’s controlling stake is excluded (only 20% is needed under the UK Corporate Governance Code for a company to respond to a resolution; any resolution result over 20% is a very strong result). Tom Powdrill, an expert on decent work and responsible investment, said the results were possibly the most successful on a social issue in a decade.

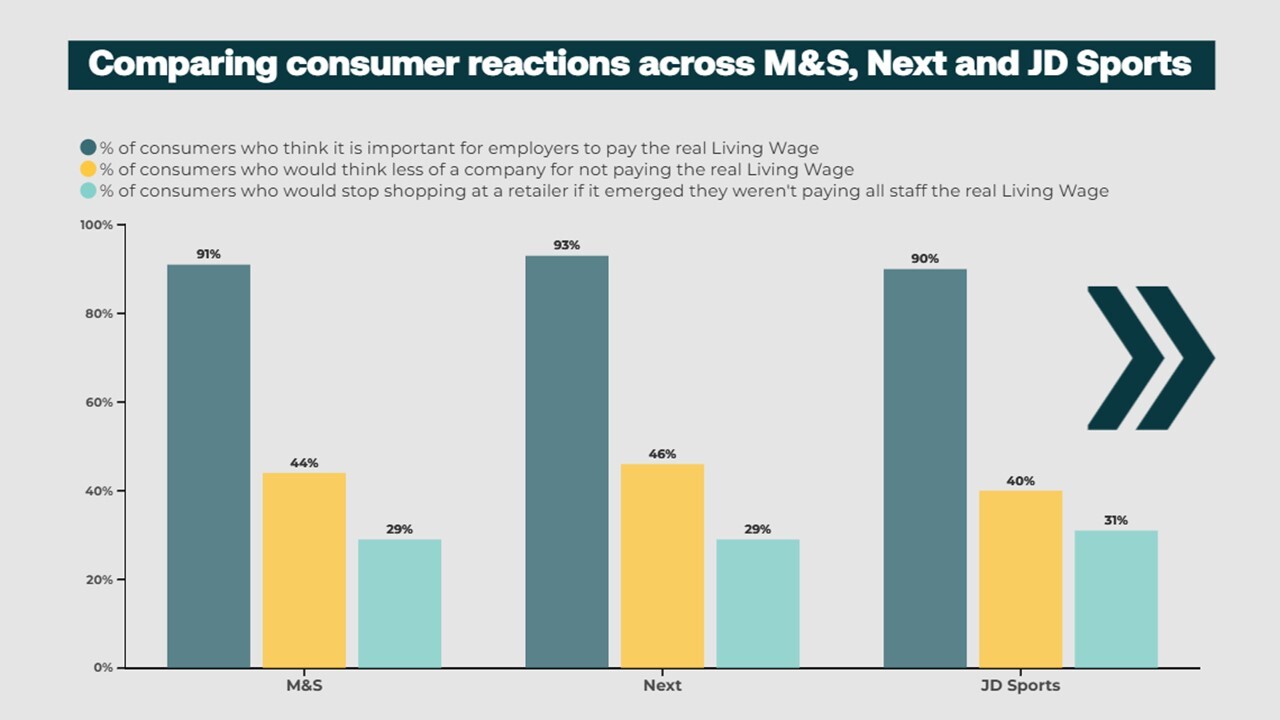

This strong level of investor support mirrors public sentiment, with 73% of M&S shoppers, 75% of Next shoppers, and 71% of JD Sports shoppers saying they would either stop shopping with or think less of these brands if they weren’t paying all staff the real Living Wage. Together, these figures send a powerful message to the high street and the boardroom.

Chart comparing consumer reactions across M&S, Next and JD Sports.

And it’s not just investors and customers who care. Members of the public who save into pensions funds, many of whom are customers of these businesses as well, are demanding change too. The funds that manage their money are among the largest investors in the UK economy. They have the power to influence corporate behaviour, set standards, and drive change. And increasingly, their members want them to use that power.

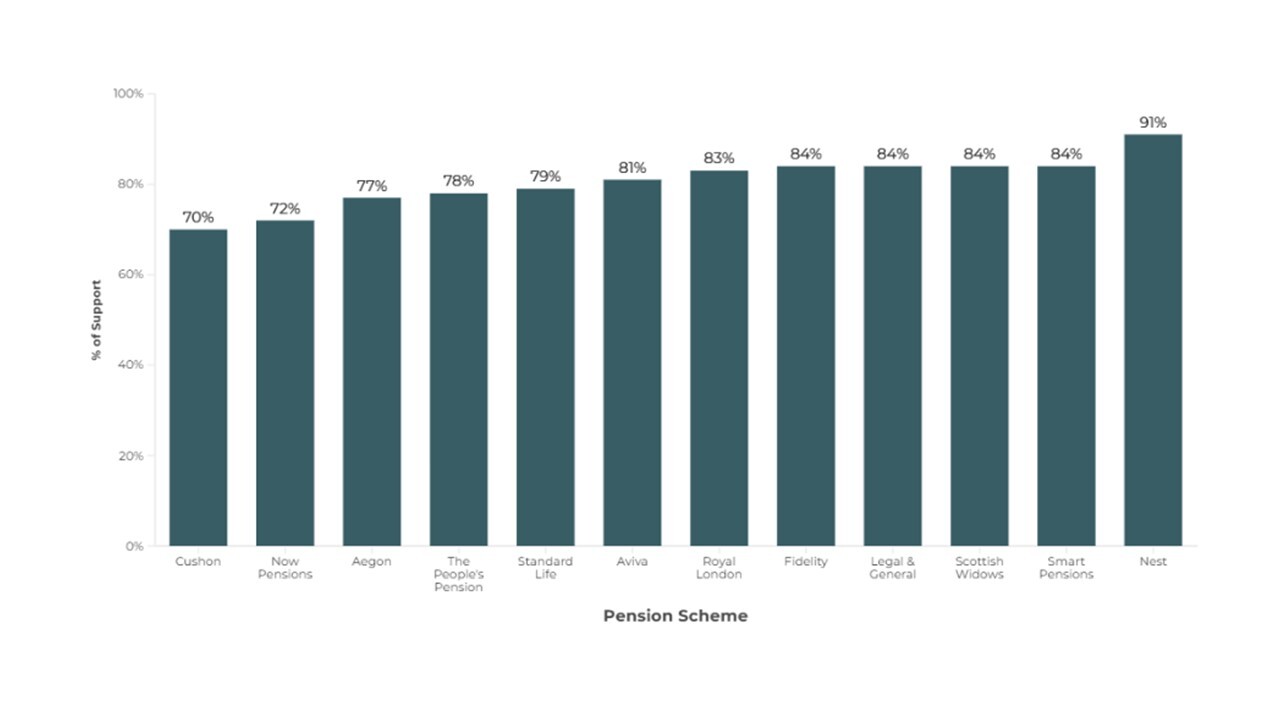

Across the board, 80% of pension fund members said it’s important that their savings are invested in companies paying the real Living Wage. Support was particularly strong among members of major schemes like Nest (91%), Legal & General (84%), and Aviva (81%).

Savers are also consumers: more than two-thirds said they would stop shopping with, or think less of, retailers that fail to pay staff fairly. This growing alignment between consumer behaviour, expectations of pension savers and shareholder votes represent a powerful opportunity – and a clear mandate – for raising standards on pay across the economy.

Chart showing support for savings to be invested in companies paying the real Living Wage across pension schemes.

Why This Matters

This polling shows that savers care about wages, working conditions, and fairness. They want their money to reflect their values. At ShareAction, we’re exploring how to amplify the voices of savers in the investment system. The message from the public is clear: low pay is unacceptable, and companies that fail to treat their workers fairly risk losing trust – and customers.

Click here to download the full data set.*

*Please contact Ruan at ruan.opiemeres@shareaction.org if you want to share this polling more widely.